IBC Help Homebuyers

As per the IBC Rules, only financial creditors may be part of the creditors' committee (COC). COC agrees on any part of the plan for a restoration, the settlement process, etc. Prior to the 2018 reform, homebuyers or borrowers were not part of the institutional creditors. They were also unable to vote in the COC, which caused a petition to bring homebuyers under financial creditors.

On 06/06/2018, allotments for real estate ventures were included in the definition of financial creditor with an interpretation added in section 5(8) of IBC, by IBC (Amendment) Ordinance, 2018. Now, as a financial creditor, the homebuyer or allottee in the real estate project can initiate the insolvency process.

How will IBC Support HOME-BUYERS

IBC provisions may provide a great deal of support to home buyers who are facing a delay in the possession or non-refund of money, etc. Let us give a brief statement on some of the prevailing circumstances:

1. Delay in Possession – As per RERA. In terms of completion, 70% of real estate developments has postponed their project. What like that Rs.5.80 Lac Crs are involved in such projects, If a petition & default is made on the grounds of an arrangement or an order of some court / authority order, you may file a case under IBC to start insolvency proceedings.

2. The project is abandoned – If the project is abandoned, you will petition NCLT under IBC to begin a corporate insolvency settlement process according to the terms of the arrangement and other legal criteria.

3. Non-refund of the agreed amount – If the allocation letter or agreement gives the right to claim a refund of the amount and that obligation is eligible for default under IBC, the application may be filed before NCLT under IBC for recovery.

4. Subvention scheme – There are several forms of subsidizing system that builders are providing to lure customers. Many of these systems are not properly dealt with. When there is some time value of money or payment for the use of money and such duty count as default under IBC, the allocated party may file a petition under IBC before NCLT.

Claim Filing Before NCLT

Many builders undergo CIRP (corporate insolvency resolution process) before NCLT. The filing of claims is mandatory to take part in the CIRP procedure and to recover the amount from the corporation. After filing the petition, it is necessary to evaluate the various IRP or RP resolution proposals. This needs the CIRP to maintain track of the changes.

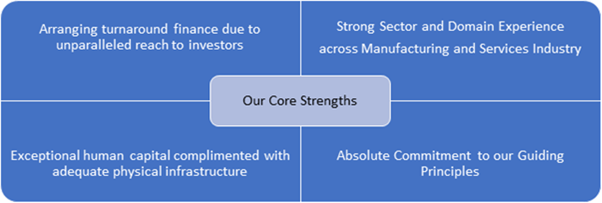

How will Rajput Jain & Associates help you?

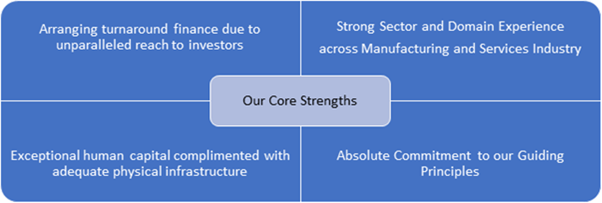

Rajput Jain & Associates has team of professionals for both RERA and IBC. Our RERA Team has already conducted many cases of lawsuits throughout India.The IBC Team consists of trained insolvency professional. Whole team operates in harmony to optimize efficiency & fairness. Few of our specialised services are mentioned here under;

- Interim Resolution Professional (IRP)

- Resolution Professional (RP)

- Representation on Committee of Creditors

- Liquidator

- Corporate consulting for Resolution / liquidation

- Preparation of RFRPs, Evaluation Matrix, Process Documents

- Identification of prospective resolution applicants, investors, lenders.

- Managing operations/cash flows of the entity under Insolvency.

- IBC Acquisition Strategy Advisory for resolution applicants for acquisition of assets / entities through the CIRP / Liquidation process

- Preparation of Resolution Plans

- Legal Advisory Service / Representation

- Interim Finance / Fund Syndications

For more details, please email us at info@carajput.comor call our support desk.