Become A Resolution Applicant

The Insolvency and Bankruptcy Law, 2016 ('IBC'), was implemented with the intention of reorganizing and addressing the insolvency of private entities that are unable to pay their creditors in a time-limited manner.

In fact, the goals of the IBC include:-

- Maximizing the value of corporate assets.

- To foster entrepreneurship.

- Availability of the loan.

- Balance of interests amongst all parties

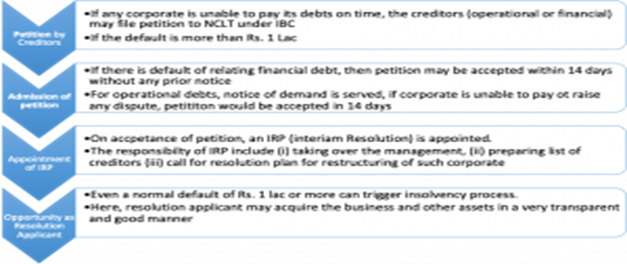

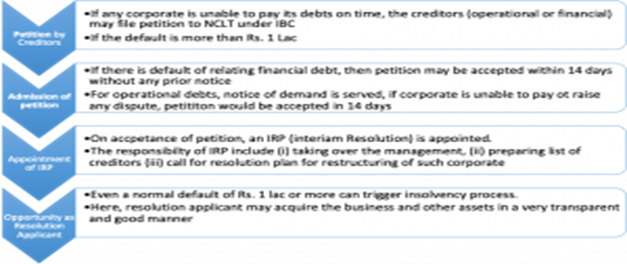

IBC Process, As A Glance

Resolution Applicant, A New Opportunity

As shown above, upon acceptance of the IBC petition, an Interim Resolution Professional ('IRP' or RP') is appointed to take over the management of the Corporate Person against whom insolvency proceedings have been initiated. The IRP then has the responsibility

- Public announcement for the submission of claims by all creditors (financial or operational)

- Preparation a list of all claims

- Scheduling of the Statement of Affairs

- Ask for a resolution plan

It is a resolution plan – the resolution plan is a plan formulated by the insolvency resolution applicant regarding a corporate debtor's continuing concern.

How to become a Resolution Applicant in the IBC?

Following an invitations from the IRP, any person qualified under the IBC can apply a resolution plan and become a resolution applicant. The resolution plan must be formulated on the basis of a memorandum of knowledge.

Through taking this chance to become a resolution candidate and submitting a resolution application, any company will benefit from those advantages. Few of them are listed below:-

A) Acquisition of a company – if entity is trying to buy on a particular enterprise value, there is an incentive for them to actually apply a realistic settlement strategy that allows them to take over the company that is operating and to have a full structure in place.

B) Penetrating into a different domain – if any company is trying to join a new domain or a new domain, it is easy for them to do so. The person only needs to apply a settlement proposal to the Settlement Specialist, and if it is approved then it would be easy for that company to enter such a new territory.

C going to promote entrepreneurship:- Becoming a resolution applicant is easy to get into business. Rather than starting from scratch, it will be easier for new entrants to invest a small amount and to acquire a potential business in the future.

D) Comparative low cost:- As long as the business is exposed to insolvency, the valuation of its reputation and even the costs of those goods are influenced by consumer sentiments. Therefore, there are certain intangible properties correlated with each company that lose their interest through the settlement process. On the basis of these points, the price proposed for resolution is much lower than the price requested by that party if it were not subject to insolvency.

E) Better understanding with creditors and stakeholders – The resolution proposal is approved by the creditors' committee, which means that it would provide an understanding with creditors for the future.

Why Rajput Jain & Associates?

Rajput Jain & Associates is a corporate consultancy firm founded by the professional with a mission to offer one-stop experience solutions under one roof for turn-key GTL (Law, Tax and Legal) services with specialized expertise. Within one location, Rajput Jain & Associates plays the function of a full company with advice and practice. This is achieved by pooling together in different experts, passing on their analysis and working as customized with the client.

Now you will have a good understanding of our goal, which is to let our clients focus on their core values and vision, leaving time-consuming monitoring, financial preparation, and part of the execution to us.

"Debt Recovery Management" (DRM) division of "Rajput Jain & Associates" is a team of qualified practitioners, including Chartered Accountants, CS, Former Government Officials and Lawyers, specializing in debt recovery management only.

We offer our services in all types of claims, whether small or large, and serve clients nationwide on a contingency basis. We ensure a quick recovery of your money owed, and we make sure it doesn't rest in someone else's bank.

Support to Resolution Professionals

We also provide secretarial assistance with the secretarial work to the Resolution Professionals. These services include the following:

- Publishing the public announcement in newspapers as per the guidelines of the Insolvency and Bankruptcy Board of India Regulations (Insolvency Resolution Process for Corporate Persons), 2016.

- Formulating / drafting the Agenda for the Meeting of Committee of Creditors. The agenda is prepared by our team of experts as per IBC 2016.

- Preparation and sending of the Notice of Meeting by appropriate means. Our team prepares the notice as per the guidelines of the Insolvency and Bankruptcy Board of India Regulations (Insolvency Resolution Process for Corporate Persons), 2016.

- Preparation of the Minutes of the Meeting.

- Prepare the Action Taken Report which is based on the decisions taken during the previous meetings.

- Compile the Information Memorandum as per the Insolvency and Bankruptcy Board of India Regulations (Insolvency Resolution Process for Corporate Persons), 2016. The Information Memorandum contains the financial particulars of the Corporate Debtor.

- Correspondence with Banks and Statutory Authorities regarding the initiation of Corporate Insolvency. Our team ensures that there is complete compliance of the IBC 2016.

- Other additional support such as arranging Valuers for valuation of assets of corporate debtors, security agencies for safe guarding the physical assets of the Corporate Debtor and E-voting / IT Support are also provided by us.

- Other additional support such as arranging Valuers for valuation of assets of corporate debtors, security agencies for safe guarding the physical assets of the Corporate Debtor and E-voting / IT Support are also provided by us.

Our characteristics:

- Specialized and professional leadership representatives

- PAN India and all of the business

- Service charges that match all sizes of the business

- Online Track Status

- Strong rate of success

If we're on board, Rajput Jain & Associates will assertively, however lawfully, try your money back. The transaction would also require the acquisition of the outstanding debt of the target corporation, which is referred to as the "assumed debt" by the purchaser. Rajput Jain & Associates is going to be the purchaser to handle the cumbersome recovery so that the target company can recover its money.

For more information, please email us at info@carajput.comor call our expert at 9555555480.